The second post in our student loan refinancing companies series focuses on Credible, a student loan refinancing marketplace that gives you access to multiple lenders with just one application.

Credible doesn’t do any lending itself, but rather aggregates personalized offers from different lenders, including banks and online companies. This allows you to apply for refinancing with multiple lenders all in one place.

Student loan debt isn’t just a problem for millennials. It’s following baby boomers into retirement as well.

The government has collected about $1.1 billion from Social Security recipients of all ages to go toward unpaid student loans since 2001, including $171 million in 2015, the Government Accountability Office said in December.

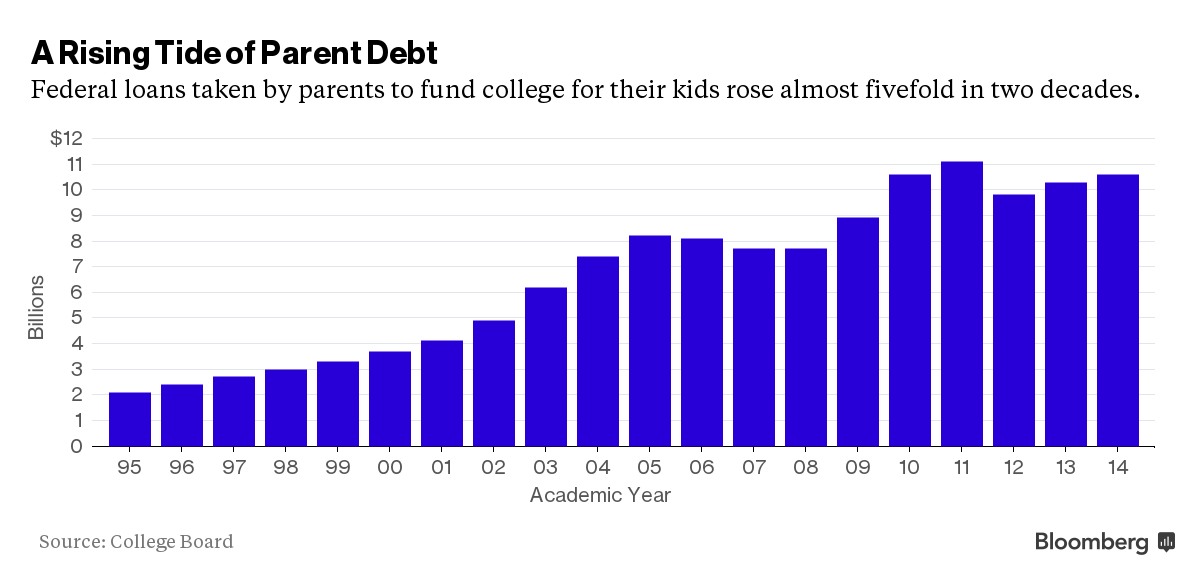

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

With the average student debt load rising for college graduates, it’s not surprising that many parents feel obligated to help pay their kids’ student loans to prevent them from falling behind.

According to a survey of 5,000 Americans released Thursday by Citizens Financial Group, as reported by MarketWatch, 94% of parents of college students ages 18 to 24 say they think their personal burden for their kids’ college student loan debt is increasing.