Student debt remains an enormous societal and economic problem, with the average college graduate leaving school with $29,400 in loans, according to College Access and Success. It would be one thing if these graduates were entering an economy with many high-paying jobs available, but that simply isn’t the case, Charles Stevens writes in a fantastic […]

Many of the nation’s top universities, such as Harvard, Stanford and Duke, are lauded for having need-blind admissions policies, meaning they don’t take into account a student’s ability to pay for college when making admissions decisions. These schools say the policy a way to make sure the best students are accepted because of their merit, […]

It’s an age-old question that’s been debated by philosophers from Socrates to The Notorious B.I.G.: Does mo’ money equal mo’ problems? It just might, if that money is being taken out to pay for college. Graduates with student debt are less happy Many students and families think that attending a prestigious, well-known college is the […]

Is a college degree worth the cost? Should everyone go to college? In the video below from CNN Money, “Freakomics” author and journalist Stephen Dubner answers these questions about higher education and offers his take on the rising cost of college. Dubner says that, overall, getting a college degree pays off over time. If, however, […]

It’s official: the class of 2014 is the most indebted college class ever.

According to an analysis by Mark Kantrowitz published in the Wall Street Journal, the average 2014 college graduate has $33,000 in student loans, the most by any previous class.

Just a year ago, we were talking about how the class of 2013 was the most indebted class ever, but, as has been the case for the past 20 years, the record has been broken by this year’s class.

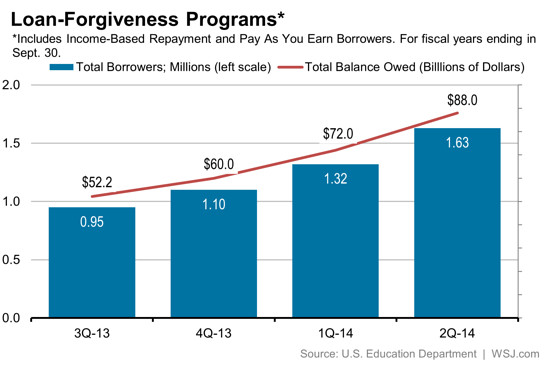

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.

What’s keeping millennials up at night? It’s not just Netflix–it’s student debt.

NPR’s Morning Edition recently asked young adults, members of the millennial generation, what their biggest concerns were.

The results were telling: almost two-thirds responded that college debt was their biggest worry.

Good news (finally!) for young college graduates.

According to a survey released on April 16, employers said they plan to increase the number of college graduates they hire this year by nearly 9 percent.

Hechinger Report recently published a great opinion piece from Karen Gross on the ‘flawed conversation’ regarding the cost of higher education. She says that too much public focus is placed on the hard costs of college, and not enough on the repercussions of taking out student debt and alternative repayment options for students. We couldn’t agree more with her claims. […]

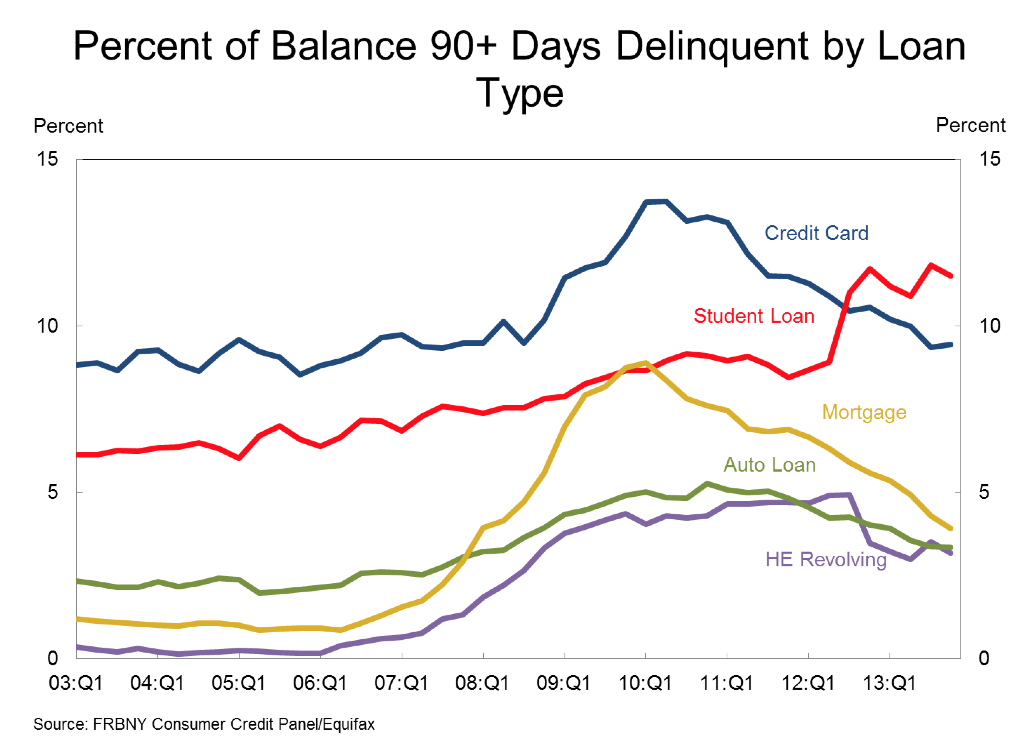

More bad news for student loan borrowers: student loan debt is growing faster than any other type of debt–and more and more borrowers are falling behind on their payments.

According to the most recent consumer debt report by the Federal Reserve Bank of New York released on February 18, 2014, student loan debt is outpacing debt from credit cards, mortgages, auto loans, and HE Revolving loans.

And that’s not all–the percentage of student loans that are 90+ days delinquent is growing fastest as well.