As college costs have risen, financial aid at most colleges hasn’t kept up, leaving students to make up the difference with loans.

According to Peterson’s, the average college only provides enough scholarships or grants to meet 70% of what low- and moderate-income students need to pay their college bill.

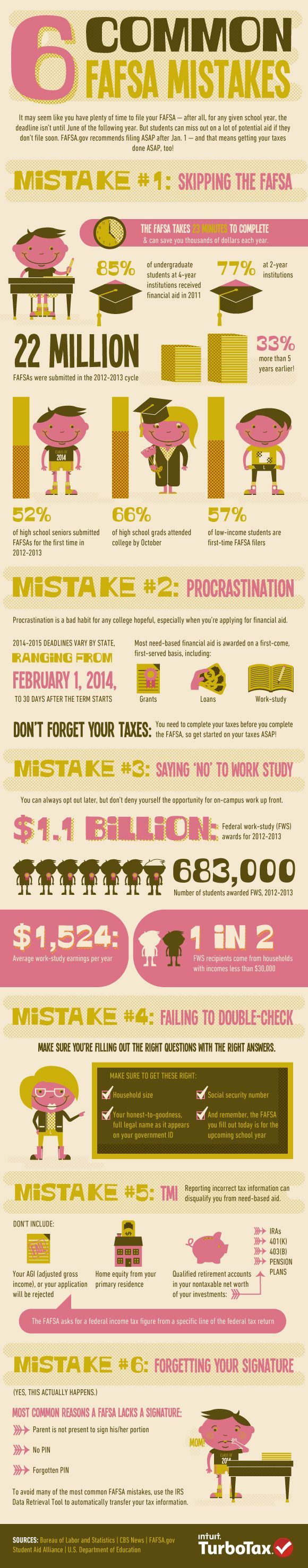

It’s FAFSA season–and if you haven’t completed your Free Application for Federal Student Aid, now’s the time to do it.

This new infographic from CampusLogic shows some interesting facts about the FAFSA that might surprise you.

It’s a common myth that financial aid is only for low-income students, and if you make too much money, you have no chance of receiving financial aid.

But according to a recent analysis by Slate, this couldn’t be further from the truth.

In fact, both public and private colleges award financial aid to a significant percentage of middle-class students.

While college is extremely expensive, there’s a lot of free money out there going unclaimed.

In fact, according to a new analysis by NerdScholar, U.S. high school graduates left over $2.9 billion in free federal grant money on the table last academic year.

How’d they miss out on the free money?

They didn’t fill out the Free Application for Federal Student Aid (FAFSA).

Applying for financial aid can get confusing.

It can be difficult for families to keep track of all the different types of financial aid available, from grants to student loans.

But this helpful infographic from Southern New Hampshire University makes it a bit easier.

If you have a child in college this coming year, it’s time to start filling out the Free Application for Federal Student Aid (FAFSA) at fafsa.gov.

When completing the application, it’s important to make sure you’re not making any major mistakes that could jeopardize your student’s chances of receiving financial aid.

Check out the infographic from TurboTax to find out 6 most common mistakes people make on the FAFSA so that you can maximize your chance of receiving grants, work-study, and other forms of financial aid to help pay for college.

How that January 1 has come and gone, it’s time for college-bound families to start filling out the Free Application for Federal Student Aid (FAFSA).

The video below from Censtible Student clearly explains the basics of the FAFSA, including what you need to file and how to fill it out.

While the government claims to be working to make college more affordable for students, actions speak louder than words.

The House of Representatives voted last week to cut $303 million from the federal Pell Grant program–a program that provides low-income students with grants for college.

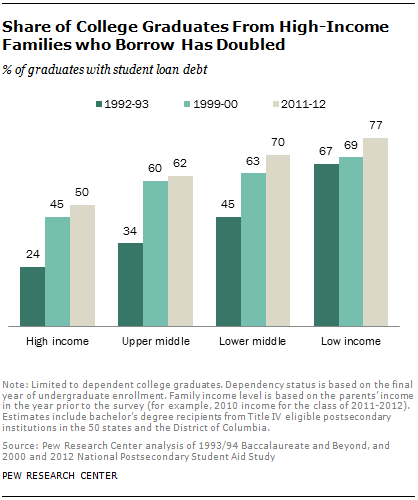

Given the consistent rise in the cost of college over the past two decades, it’s no secret that student loan borrowing and student debt are at all-time highs.

As you might expect, the percentage of students from low-income families who take out student loans to pay for college is greater than their higher-income counterparts, with 77% of low-income students borrowing for college in 2011-12 vs. 50% for high income students.

However, according to Pew Research Center, the rate at which students from more affluent families are borrowing is increasing faster than that at which low-income students are taking out student loans.

Reducing college costs doesn’t just happen once the kids have already been accepted. Planning early is the best way to reduce your college costs later on.

In this video from THV11 News, Little Rock Family Magazine editor Heather Bennett shares her five best to reduce college costs while your student is still in high school.

Check out our tips and watch the video to find out more.