As the cost of college has risen, the burden of paying for it has fallen on students more than ever.

CNBC reports that college students are saving an average of $7,801, according to the second edition of the Allianz Tuition Insurance College Confidence Index.

That’s up 17% from $6,678 in 2017.

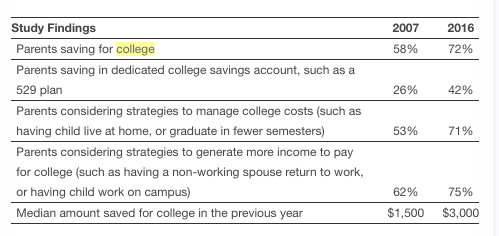

As college has gotten more expensive, more families have made it a priority to save money to put toward their children’s college education.

According to Fidelity Investments’ 10th Annual College Savings Indicator Study, as reported by GoodCall, the percentage of parents saving for college is at an all-time high.

Most parents look forward to their children graduating from college, as it marks the time in their lives when they can start becoming real adults and taking care of themselves–moving out, finding a full time job, and potentially getting married, having kids, or buying a home.

But a recent study from the University of Arizona, as reported by CNN Money, has found that that’s not the case for more than half of recent college graduates, who report they still depend on their parents for money.

People are always telling parents to put away money for their children’s college education, especially with the cost of college rising so quickly over the past two decades.

But it’s not always easy.

Between the mortgage, car payments, and other expenses, many parents find it nearly impossible to save money for college. And most aren’t even sure how much to save, especially when they’re trying to save for retirement at the same time.

Reducing college costs doesn’t just happen once the kids have already been accepted. Planning early is the best way to reduce your college costs later on.

In this video from THV11 News, Little Rock Family Magazine editor Heather Bennett shares her five best to reduce college costs while your student is still in high school.

Check out our tips and watch the video to find out more.

With the average student debt load rising for college graduates, it’s not surprising that many parents feel obligated to help pay their kids’ student loans to prevent them from falling behind.

According to a survey of 5,000 Americans released Thursday by Citizens Financial Group, as reported by MarketWatch, 94% of parents of college students ages 18 to 24 say they think their personal burden for their kids’ college student loan debt is increasing.

It’s no secret that college is a huge investment in your future, and costs are rising at most colleges and universities. With the price so high and student loan debt increasing, it’s never been more important to be careful how you spend your college dollars. But which colleges pay off? Are 96% of U.S. colleges […]

Whether you or your child is preparing for college or already enrolled, your family can benefit from working with a financial aid consultant to save time and money on college.

Here are 9 reasons you should consider working with a financial aid consultant.

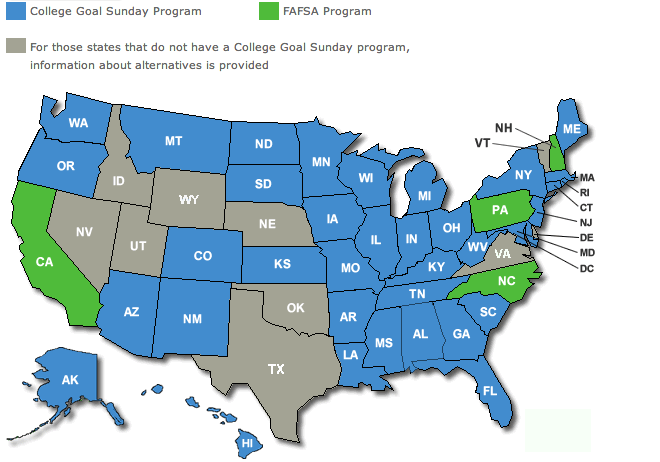

Need help filling out your FAFSA? There’s likely a FAFSA filing event happening near you in the next couple of months.

Check out this map and click on your state for a list of locations, dates, and times for events happening in your state.

During the college admissions process, the cost of standardized testing, test prep services, college applications, and college visits can really add up.

And that’s before you even start thinking about paying for major expenses like college tuition, fees, textbooks, room, and board.

With college such an expensive investment, you may be wondering why anyone would pay someone just to help them figure out how to pay for it.