Parents paying kids’ student loans while putting off retirement savings

With the average student debt load rising for college graduates, it’s not surprising that many parents feel obligated to help pay their kids’ student loans to prevent them from falling behind.

According to a survey of 5,000 Americans released Thursday by Citizens Financial Group, as reported by MarketWatch, 94% of parents of college students ages 18 to 24 say they think their personal burden for their kids’ college student loan debt is increasing.

Parents worry about negative impact of kids’ debt

Many parents are worried that their child’s student loan debt will make it more difficult for their child to be financially independent after graduation. And 84% of parents say that college debt will impact future generations’ ability to buy a home, according to the Citizens survey.

This feeling of guilt and negative view of their children’s future has caused more parents to help out with their children’s student loan payments, with more than half saying they were very likely or somewhat likely to do so, according to a survey released by Discover Student Loans in June.

Retirement savings suffer as parents pay for college

But experts say this is a bad idea–especially if it impacts parents’ ability to save for retirement, as it has for many families. As Catey Hill writes for Marketwatch,

Most parents are in no position to help their kids pay off student loans.

According to a survey released last year by the National Institute on Retirement Security, households where the head of household is 45 to 54 (these are likely to have kids who are around college age) that have saved anything for retirement only have balances of $60,000, well below what’s needed for retirement, according to many financial experts.

Parents have their own loans to pay

And on top of paying their kids’ loans, parents have their own student loans to take care of–either from their own studies or PLUS loans they took out to help their child initially.

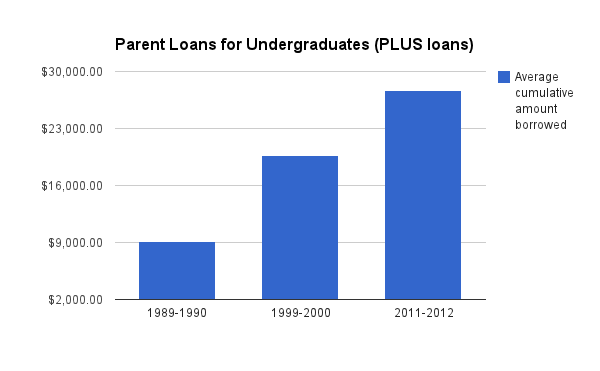

In fact, more parents are feeling the burden of these loans. In 2011, 21% of parents took out a PLUS Loan, and each loan carried an average balance of $27,700 in inflation-adjusted dollars.

Parent PLUS Loan balances have skyrocketed over the past two decades. (Source: Education By The Numbers)

If parents aren’t paying off their kids’ student loans or their own, they’re often helping in another way–maybe paying for rent or giving their kids a stipend.

But again, if it hurts your retirement, it’s a bad idea. As Michele Clark, a certified financial planner at Clark Hourly Financial Planning and Investment Management tells parents, “take care of yourself first so you will not be a burden to your kids later on.”

Parents can help kids without paying loans

This doesn’t mean you have to ignore your kids’ cries for help completely. Helping your child find better student loan repayment options, like an income-based repayment plan, can decrease their monthly burden.

Letting them live at home and pay a reduced rent can also help your kids save up some cash until they can afford to live on their own. The article also recommends letting them contribute to your business, if that’s an option.

Help your kids avoid debt early if possible

And you don’t have to wait until after college to help your children save money and reduce their student debt. Encouraging your student to apply for scholarships or find a part-time job can help ease their debt burden later on.

And if your student hasn’t yet started college, helping them find an affordable college that leaves them with minimal debt is truly the best thing you can do for them.

If you want to help your child with loan repayment without paying the loans yourself, or if your student is gearing up for college and you want to find ways to make it more affordable for them and your family, feel free to give us a call at 1-888-234-3907 or contact us using this form.

college debt, college loans, parents, paying for college, plus loans, student debt, student loan debt, student loan repayment, student loans