More parents than ever saving for college

As college has gotten more expensive, more families have made it a priority to save money to put toward their children’s college education.

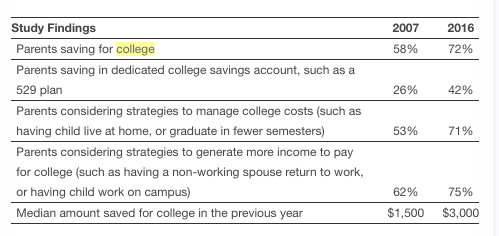

According to Fidelity Investments’ 10th Annual College Savings Indicator Study, as reported by GoodCall, the percentage of parents saving for college is at an all-time high.

Record percentage of parents saving for college

The study found that a record percentage of parents, 72%, have started saving for college, compared with 69% in 2015 and 58% in 2007.

Each month, parents are saving an average of $300 for college.

Parents who are saving for their children’s education are hoping to save enough to pay for 70% of the cost, up from 66% last year and 57% in 2012. They expect scholarships, student loans, gifts and money from their children to cover the remaining 30%, according to the study.

While that’s a great goal, Fidelity found that parents are only managing to save 29% of their target budget, in large part because the cost of college continues to rise.

Parents are trying to reduce college costs

According to the College Board, the average cost of a year at a private college is $32,410, $9,410 for in-state students at a public college and $23,890 for out-of-state residents attending a public college.

Over the course of four years (or more), those costs really add up. But due to the rise in awareness of high college costs and student debt topping $1.2 trillion, more parents are taking action to save money on college.

Fidelity found that 71% of parents are looking to manage costs associated with higher education compared with 53% in 2007.

Some of the ways parents are reducing college costs include:

- Delaying their children starting college for a year or more to save more.

- Encouraging their children to graduate in fewer semesters.

- Favoring a public college over a private one.

- Having their kids live at home and commute to college.

529 plans rising in popularity

Using a 529 plan has also become quite popular among parents saving money for college, with 41% of parents saying they used one. This is up from 39% last year.

529 plans allow families to put aside money tax-free for their children’s college expenses.

According to Brian Boswell, vice president, research and development at Savingforcollege.com,

People are using more 529 plans because it’s one of the best college savings vehicles.

529 plans offer a lot of benefits that are unique to them. States are often adding their own perks on top which is increasing usage.

Helping families make college more affordable

Whether it’s through a 529 plan or other savings vehicle, it’s certainly a positive sign that more parents are recognizing the need to save for college and reduce their costs when possible.

We help families and students make college more affordable, maximize their financial aid packages and minimize college debt.

If you’d like to learn how we can help you, call us at 1-888-234-3907 or send us a message and we’ll get back to you as soon as possible.