As the cost of college has risen, the burden of paying for it has fallen on students more than ever.

CNBC reports that college students are saving an average of $7,801, according to the second edition of the Allianz Tuition Insurance College Confidence Index.

That’s up 17% from $6,678 in 2017.

As college has gotten more expensive, more families have made it a priority to save money to put toward their children’s college education.

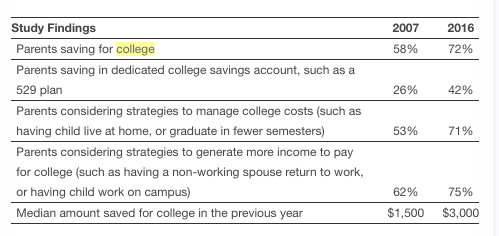

According to Fidelity Investments’ 10th Annual College Savings Indicator Study, as reported by GoodCall, the percentage of parents saving for college is at an all-time high.

Even though college costs are rising rapidly each year and could reach $334,000 by 2018, fewer families are saving for it than last year, according to a new survey from student loan servicer Sallie Mae. Just 48% of U.S. families are saving for their children’s college education, compared to 51% last year, MainStreet reports. Families are […]

Whether you or your child is preparing for college or already enrolled, your family can benefit from working with a financial aid consultant to save time and money on college.

Here are 9 reasons you should consider working with a financial aid consultant.

With the cost of college reaching as much as $63,200 at the nation’s most expensive college, Sarah Lawrence, getting financial aid has become a necessity for most families and students.

There are several steps families can take to maximize their financial aid package in order to make college more affordable.

According to U.S. News Education, here’s how to get colleges to show you the money.

Getting those last-minute applications in? Make sure you’re applying to plenty of schools that offer financial aid and scholarships.

In case you missed them, check out our best posts on finding affordable schools, finding scholarships, and paying for college.

This video from Reuters TV offers a year-by-year plan for high school students and their parents to help them prepare for college. It includes some great tips on saving for college and how to get the most financial aid possible.

This summer, college students and their parents narrowly avoided a student loan interest rate hike that would have raised interest rates on new subsidized Stafford loans from 3.4 percent to 6.8 percent. The deal set Federal Stafford Loans for undergraduates at 3.85%, Graduate PLUS loans at 5.4%, and Parent PLUS loans at 6.4%.

While college-bound students and their families breathed a collective sigh of relief, the deal came with a catch: student loan interest rates would be tied to the health of the economy. If the economy improves as economists predict, rates would increase in coming years. In fact, rates would likely climb higher than they were this past spring.

For families who have saved for college with a 529 plan, the new deal presents an interesting conundrum. Should you use the funds in your account now to pay for your student’s education or save them for the future, when it might be more expensive to borrow?

Even if you’re only a high school freshman, it’s never too early to start thinking about college.

Planning ahead can help keep high school students on track so they are well-prepared for college, instead of scrambling to choose a college and fill out applications at the last minute.

Even with today’s high cost of college, it’s still possible to pay for school without taking out student loans. This article offers some great tips and advice for reducing college costs, from taking college classes while you’re still in high school to actively searching for scholarships all through college. Because of her diligence, the author was […]