Finding a job right after graduating can be tough. And for graduates with student debt, there’s added pressure to find a job and make enough money to afford student loan payments once their grace period has ended.

Luckily for college graduates in New York state, there’s a new student loan forgiveness program that makes it easier for them to adjust to life after college–without having to repay their student loans.

Wondering what to get the millennial in your life this Christmas?

Consider giving them something they probably need: a gift toward their student loan payments.

According to MarketWatch, a new site called LoanGifting allows family, friends and others to make payments directly toward someone’s student loans.

The government recently dropped some huge news for those with federal student loans.

Starting Dec. 16, all federal student loan borrowers will be eligible for an alternative repayment plan called Revised Pay As You Earn (or REPAYE), MONEY reports.

The average college graduate now leaves school with $30,000 in student debt, and the national student debt total of $1.3 trillion is rising every day. Many prospective college students don’t realize the huge impact student debt can have on their lives–and how much compound interest can add up over time, resulting in a much larger […]

We write a lot about the country’s rising student loan debt and the fact that it’s already over $1.3 trillion, as well as the effects it’s had on the economy and borrowers’ lives.

But it’s a lot different to actually see it grow by the second. MarketWatch has created a national student loan debt clock to help people visualize just how quickly student loan debt is growing, and it’s pretty sobering to watch.

In fact, by the time you finish reading this post, it will likely have grown by $366,600.

With 70% of college graduates now leaving school with debt and the national student loan debt now at $1.3 trillion and growing, there have been many proposed solutions on how to combat the country’s student loan problem. According to Martin O’Malley, the former governor of Maryland, the federal government must act swiftly to stop the student […]

It’s no secret that student debt is a big issue for millions of Americans. We’re constantly hearing scary statistics about the rising amount of student loan debt (currently over $1.2 trillion) and how many borrowers are struggling to repay their loans.

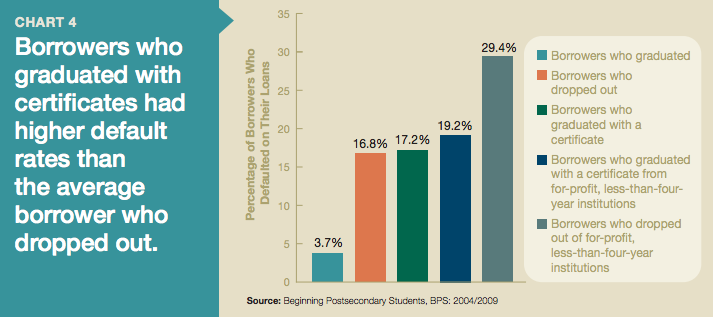

But a recent study, as described in U.S. News & World Report, showed that three types of borrowers are struggling the most and accounting for a large part of the high numbers we hear associated with student debt.

Dropping out of a college, in general, makes borrowers more likely to default on their student loans, because it makes it more difficult for them to find a good-paying job and afford their student loan payments.

But certain college dropouts have it worse than others–those who dropped out of a for-profit, less-than-four-year college.

Over 100 students who attended the now-defunct for-profit Corinthian Colleges system are striking out against their former college and refusing to repay their student loans.

The students are attempting to pressure the government into forgiving their debt, alleging that the colleges didn’t hold up their end of the bargain–by providing a subpar education and not preparing them for a post-graduate career.

While the White House has introduced recent proposals to lower the cost of college for incoming students, the 40 million Americans struggling with student loan debt haven’t seen much relief.

But President Obama’s new Student Aid Bill of Rights could help change that and make borrowing and repaying federal student loans a less painful process.