Given the consistent rise in the cost of college over the past two decades, it’s no secret that student loan borrowing and student debt are at all-time highs.

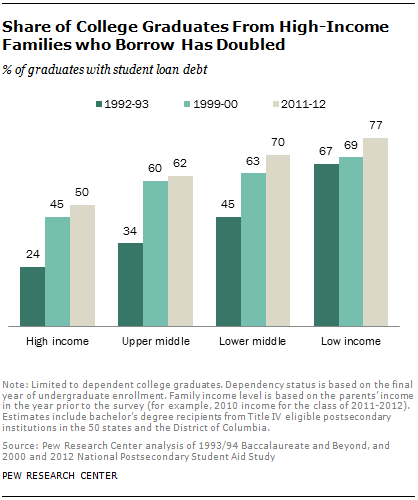

As you might expect, the percentage of students from low-income families who take out student loans to pay for college is greater than their higher-income counterparts, with 77% of low-income students borrowing for college in 2011-12 vs. 50% for high income students.

However, according to Pew Research Center, the rate at which students from more affluent families are borrowing is increasing faster than that at which low-income students are taking out student loans.

With the national student debt topping $1 trillion, more students than ever are defaulting on their student loans.

The average student loan default rate is currently at 9.1%–that’s almost 1 in 10 borrowers.

If you have high student debt, you may be thinking, what’s the worst that can happen if you don’t pay it back?

A lot of terrible things, actually. From a severely low credit score to having your wages garnished, the consequences of defaulting on your student loans are dire.

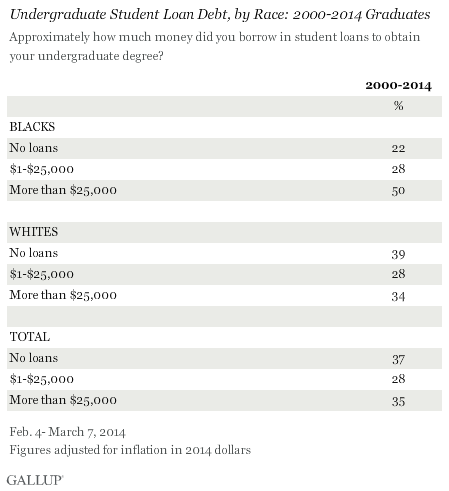

While student loan debt is a problem for most college graduates, it’s hitting one group significantly harder: black students.

A new analysis from Gallup found a significantly greater percentage of black college graduates carry student debt as compared to white students. Seventy-eight percent of black students graduate college with student loan debt, compared to 61% of white students.

They’re also more apt to carry greater debt loads, with half of black students reporting they have more than $25,000 in student loan debt, compared to only 34% of white students.

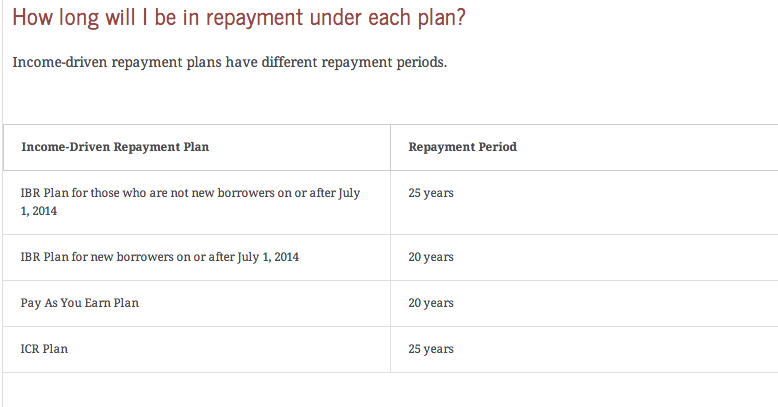

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.

With the average student debt load rising for college graduates, it’s not surprising that many parents feel obligated to help pay their kids’ student loans to prevent them from falling behind.

According to a survey of 5,000 Americans released Thursday by Citizens Financial Group, as reported by MarketWatch, 94% of parents of college students ages 18 to 24 say they think their personal burden for their kids’ college student loan debt is increasing.

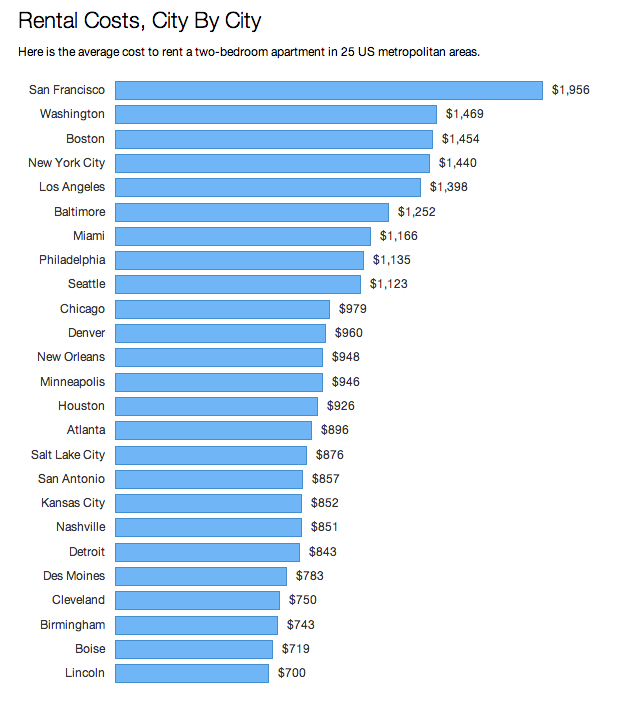

When many college students graduate, they’re tempted by the thought of moving to a big, exciting city.

Indeed, cities like New York and San Francisco provide many opportunities for work and play, so it’s unsurprising that they tend to attract hungry, eager young adults. But they’re also some of the most expensive cities in which to rent an apartment.

Many financial experts say you shouldn’t spend more than 30 percent of your income on housing, but for most graduates living in big cities, rent is their biggest expense. That’s why they often struggle to make other payments, like student loans.

When we say we are financial aid and student loan repayment consultants, many people assume we work for a college financial aid office, bank, or other outside organization.

But our work is completely independent. As student loan repayment consultants, we work one-on-one with student loan borrowers to set up a repayment schedule that allows them to manage their debt.

Dealing with the death of a child is difficult enough. But the financial stress of having to repay the child’s student loans can make such a tragic event that much more difficult to bear.

This is a heartbreaking reality for the Mason family, and many others who face the terrible tragedy of losing a child with student loans, according to a recent CNN Money story.

Student debt remains an enormous societal and economic problem, with the average college graduate leaving school with $29,400 in loans, according to College Access and Success. It would be one thing if these graduates were entering an economy with many high-paying jobs available, but that simply isn’t the case, Charles Stevens writes in a fantastic […]

Many of the nation’s top universities, such as Harvard, Stanford and Duke, are lauded for having need-blind admissions policies, meaning they don’t take into account a student’s ability to pay for college when making admissions decisions. These schools say the policy a way to make sure the best students are accepted because of their merit, […]