Student debt continues to be a major issue for college students and graduates in the U.S.

U.S. total student debt is now over $1.4 trillion, and the average debt for a college graduate in 2016 was $37,000. And 44 million Americans now have student debt to their name.

The video below gives tips on how student loan borrowers can avoid falling behind on their payments. It also explains why millennials should be saving for retirement even if they have student debt.

We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.

It just keeps getting worse. Student debt has topped $1.4 trillion, nearly more than all of the credit card and car loan debt in the U.S., according to NBC 12. And that number is growing by the second, leading many borrowers to question whether college was worth the cost. Student loan debt a widespread problem The problem is […]

Despite the many alternative repayment plans available, Americans are behind on their student loans more than any other kind of debt.

A new report from the Federal Reserve Bank of New York finds that borrowers are having a much harder time paying off their student loan debt than their credit cards, mortgages, and car loans.

Finding a job right after graduating can be tough. And for graduates with student debt, there’s added pressure to find a job and make enough money to afford student loan payments once their grace period has ended.

Luckily for college graduates in New York state, there’s a new student loan forgiveness program that makes it easier for them to adjust to life after college–without having to repay their student loans.

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

While the White House has introduced recent proposals to lower the cost of college for incoming students, the 40 million Americans struggling with student loan debt haven’t seen much relief.

But President Obama’s new Student Aid Bill of Rights could help change that and make borrowing and repaying federal student loans a less painful process.

According to the Department of Education, 7 million students in the U.S. defaulted on their college loans during the third quarter of 2014, with the average amount of loan default per borrower being $14,014.

As we’ve written previously, defaulting on your loans can have serious consequences–including damaged credit and having your wages garnished. And since student loans usually can’t be discharged in bankruptcy, many borrowers find themselves unable to repay their loans.

There are, however, ways to avoid succumbing to the peril of student loan debt and default. A recent CNBC article featured College Financing Group co-founder Rick Ross, who gave his advice about preventing student loans from taking over your life.

If you have a lot of student loan debt, you’re far from alone.

Unpaid federal student loan debt is nearly $1.1 trillion, according to the latest data from the Consumer Financial Protection Bureau. And that’s not even counting private loans.

To show how great of a number that is, Debt.com put together an infographic of all of the things you could buy with $1 trillion.

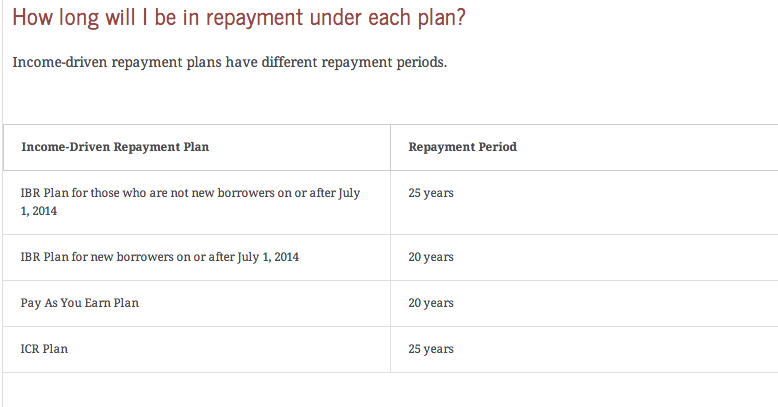

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.