Why you should avoid defaulting on your student loans

Are you falling behind on your student loan payments? Turns out, you’re not alone.

According to a report released yesterday from the New York Federal Reserve, nearly one third of student loan borrowers in repayment are delinquent on their debt.

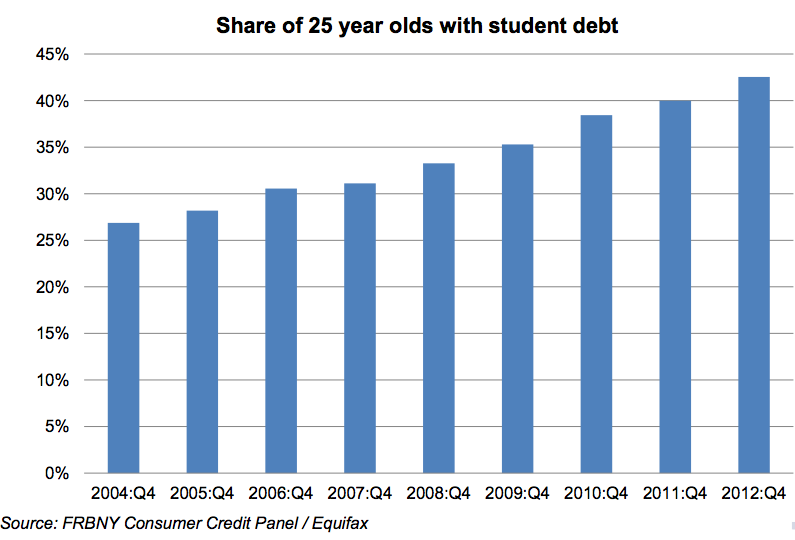

And this number is on the rise–total student loan balances almost tripled between 2004 and 2012 due to increasing numbers of borrowers and higher balances per person.

Graduating into a tough economy has made it even more difficult for young borrowers to keep up with their payments. Delinquency rates were highest for borrowers under 30, with 35% of them 90 days or more past due last year, up from 21% in 2004.

And these numbers don’t even include the 44% of borrowers who don’t have to make loan payments yet due to being in school, loan deferral or forbearance.

What does this mean for student borrowers? Falling behind on your student loans can be detrimental to your overall credit, making it that much more difficult to get a mortgage or car loan in the future. It’s vital to do everything you can to avoid delinquency to keep your credit intact.

Most lenders are willing to work with you to figure out a monthly payment you can afford, and deferment and forbearance are always an option if you’re unable to make any sort of payment. Though you may end up paying a bit more in interest over time, it’s preferable to having your credit permanently damaged by failing to make payments.

Student debt can be overwhelming, especially for recent graduates who are unsure about whether they’ll be able to find a job and a place to live and still afford their student loan payments.

To avoid falling delinquent on your loans, it’s important to weigh your repayment options carefully, stick to a realistic budget that allows you to meet your monthly payment, and be proactive about seeking outside help if you’re having trouble keeping up.

monthly payments, repayment options, student loan delinquency, student loan repayment, student loans