We write a lot about the country’s rising student loan debt and the fact that it’s already over $1.3 trillion, as well as the effects it’s had on the economy and borrowers’ lives.

But it’s a lot different to actually see it grow by the second. MarketWatch has created a national student loan debt clock to help people visualize just how quickly student loan debt is growing, and it’s pretty sobering to watch.

In fact, by the time you finish reading this post, it will likely have grown by $366,600.

Dropping out of a college, in general, makes borrowers more likely to default on their student loans, because it makes it more difficult for them to find a good-paying job and afford their student loan payments.

But certain college dropouts have it worse than others–those who dropped out of a for-profit, less-than-four-year college.

One would assume that graduating with a high level of student debt would put a borrower at greater risk of falling behind on their payments and defaulting on their student loans.

But a new report from the Federal Reserve Bank of New York found the exact opposite to be true.

Over 100 students who attended the now-defunct for-profit Corinthian Colleges system are striking out against their former college and refusing to repay their student loans.

The students are attempting to pressure the government into forgiving their debt, alleging that the colleges didn’t hold up their end of the bargain–by providing a subpar education and not preparing them for a post-graduate career.

While the White House has introduced recent proposals to lower the cost of college for incoming students, the 40 million Americans struggling with student loan debt haven’t seen much relief.

But President Obama’s new Student Aid Bill of Rights could help change that and make borrowing and repaying federal student loans a less painful process.

Not paying your student loans can have some serious consequences, including a lowered credit score and having your wages garnished.

But what if there was a way to avoid paying your student loans with no repercussions?

Actually, there is–if you quality for a student loan forgiveness program.

For recent college graduates, paying student loans can be a struggle.

But what if you could get yours paid for you just for moving to a certain city?

Niagara Falls, NY is trying to attract young residents by doing just that. The city will pay off $7,000 of a borrower’s student loans if they live in a designated area of the city for 2 years.

We’ve written a lot about the great, affordable colleges in our home state of New York.

And beginning this year, prospective college students and graduates may have another reason to consider making a move to the Empire State: free student loan payments for two years.

If you have a lot of student loan debt, you’re far from alone.

Unpaid federal student loan debt is nearly $1.1 trillion, according to the latest data from the Consumer Financial Protection Bureau. And that’s not even counting private loans.

To show how great of a number that is, Debt.com put together an infographic of all of the things you could buy with $1 trillion.

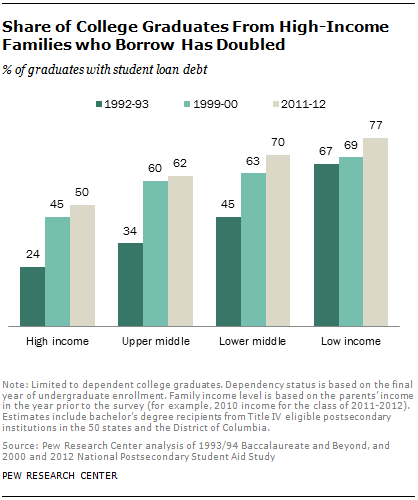

Given the consistent rise in the cost of college over the past two decades, it’s no secret that student loan borrowing and student debt are at all-time highs.

As you might expect, the percentage of students from low-income families who take out student loans to pay for college is greater than their higher-income counterparts, with 77% of low-income students borrowing for college in 2011-12 vs. 50% for high income students.

However, according to Pew Research Center, the rate at which students from more affluent families are borrowing is increasing faster than that at which low-income students are taking out student loans.