Finding a job right after graduating can be tough. And for graduates with student debt, there’s added pressure to find a job and make enough money to afford student loan payments once their grace period has ended.

Luckily for college graduates in New York state, there’s a new student loan forgiveness program that makes it easier for them to adjust to life after college–without having to repay their student loans.

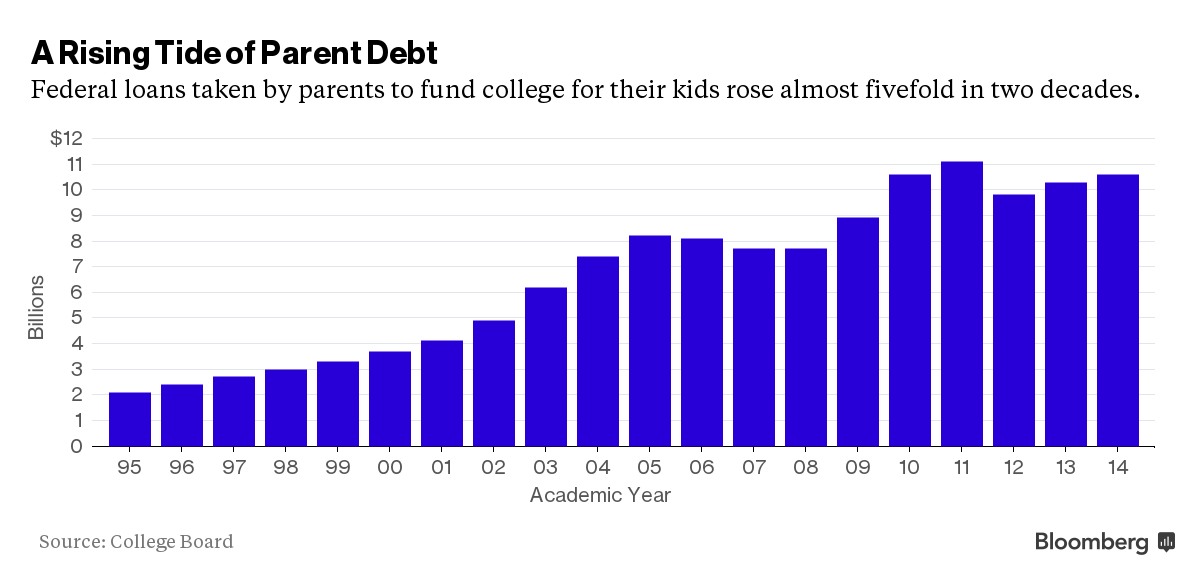

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

We write a lot about the country’s rising student loan debt and the fact that it’s already over $1.3 trillion, as well as the effects it’s had on the economy and borrowers’ lives.

But it’s a lot different to actually see it grow by the second. MarketWatch has created a national student loan debt clock to help people visualize just how quickly student loan debt is growing, and it’s pretty sobering to watch.

In fact, by the time you finish reading this post, it will likely have grown by $366,600.

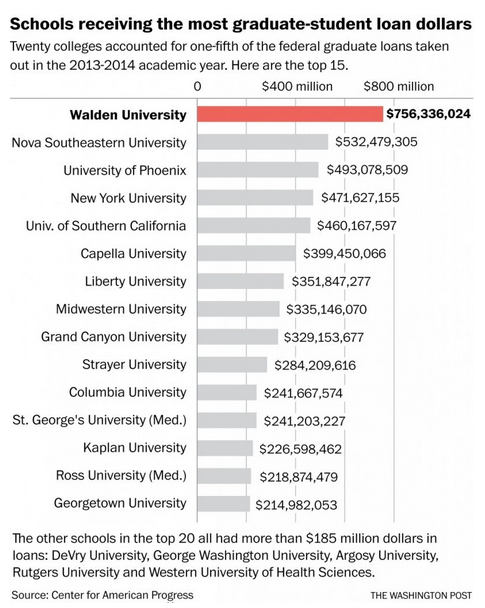

We’ve written before how graduate school debt has a huge impact on the total amount of student debt in the U.S.

Many students, unable to find a high-paying job after college, think that graduate school is the answer–only to face the reality of high debt and a minimal increase in salary and job prospects.

And according to a new study from the Center for American Progress, as reported by The Washington Post, a small number of schools are responsible for a large portion of the student debt problem.

Not paying your student loans can have some serious consequences, including a lowered credit score and having your wages garnished.

But what if there was a way to avoid paying your student loans with no repercussions?

Actually, there is–if you quality for a student loan forgiveness program.

According to the Department of Education, 7 million students in the U.S. defaulted on their college loans during the third quarter of 2014, with the average amount of loan default per borrower being $14,014.

As we’ve written previously, defaulting on your loans can have serious consequences–including damaged credit and having your wages garnished. And since student loans usually can’t be discharged in bankruptcy, many borrowers find themselves unable to repay their loans.

There are, however, ways to avoid succumbing to the peril of student loan debt and default. A recent CNBC article featured College Financing Group co-founder Rick Ross, who gave his advice about preventing student loans from taking over your life.

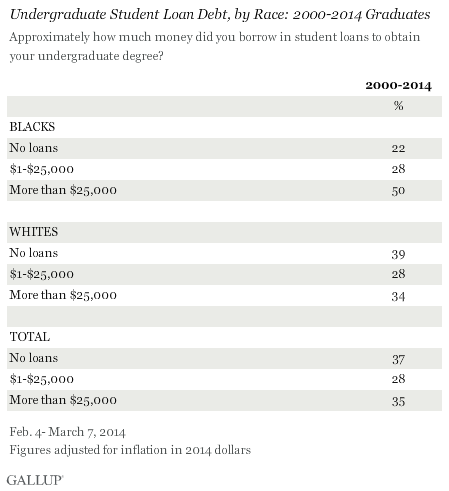

While student loan debt is a problem for most college graduates, it’s hitting one group significantly harder: black students.

A new analysis from Gallup found a significantly greater percentage of black college graduates carry student debt as compared to white students. Seventy-eight percent of black students graduate college with student loan debt, compared to 61% of white students.

They’re also more apt to carry greater debt loads, with half of black students reporting they have more than $25,000 in student loan debt, compared to only 34% of white students.

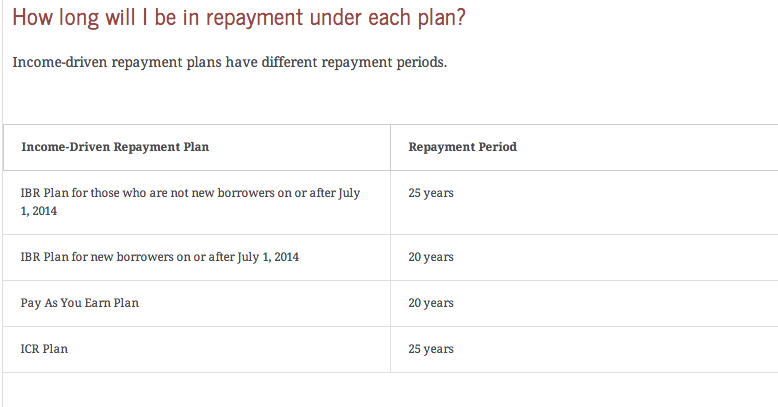

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.

With the average student debt load rising for college graduates, it’s not surprising that many parents feel obligated to help pay their kids’ student loans to prevent them from falling behind.

According to a survey of 5,000 Americans released Thursday by Citizens Financial Group, as reported by MarketWatch, 94% of parents of college students ages 18 to 24 say they think their personal burden for their kids’ college student loan debt is increasing.

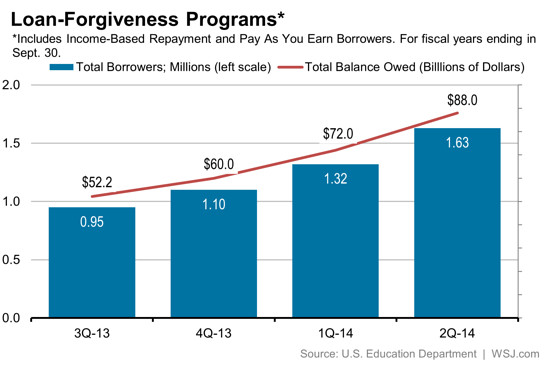

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.